From 30th April, Geolah will accept Cash Only bookings as we upgrade our system to bring you more flexible payment options. Thanks for your support!

The Platform Worker Bill takes effect from 1 Jan 2025 and seeks to strengthen the protection for platform workers in three areas: (1) CPF contributions, (2) Work injury compensation (WIC)*, and (3) Platform work association representation.

More details can be found in the respective sections below.

Do note that opting in to CPF contributions may lower your take-home earnings.

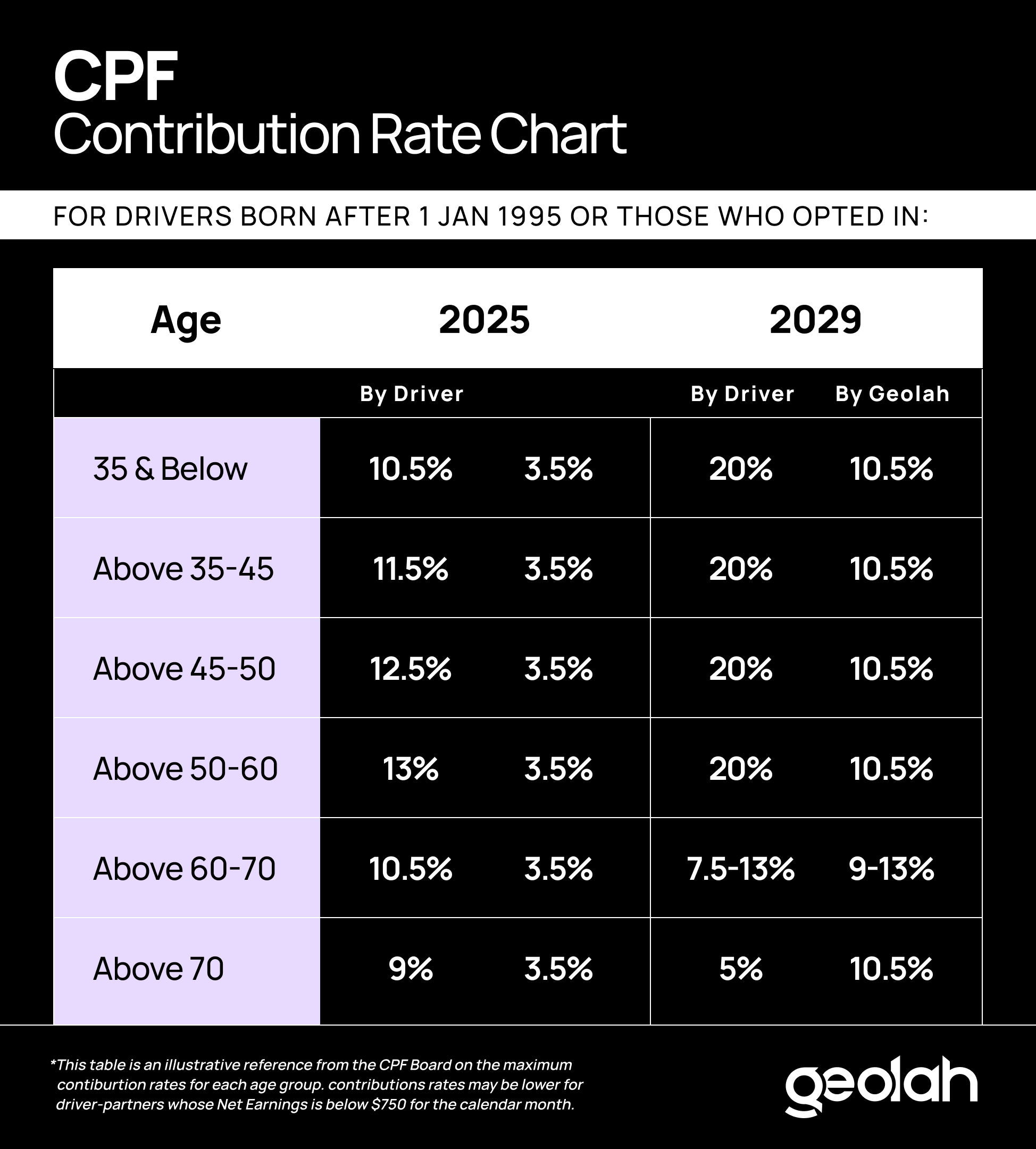

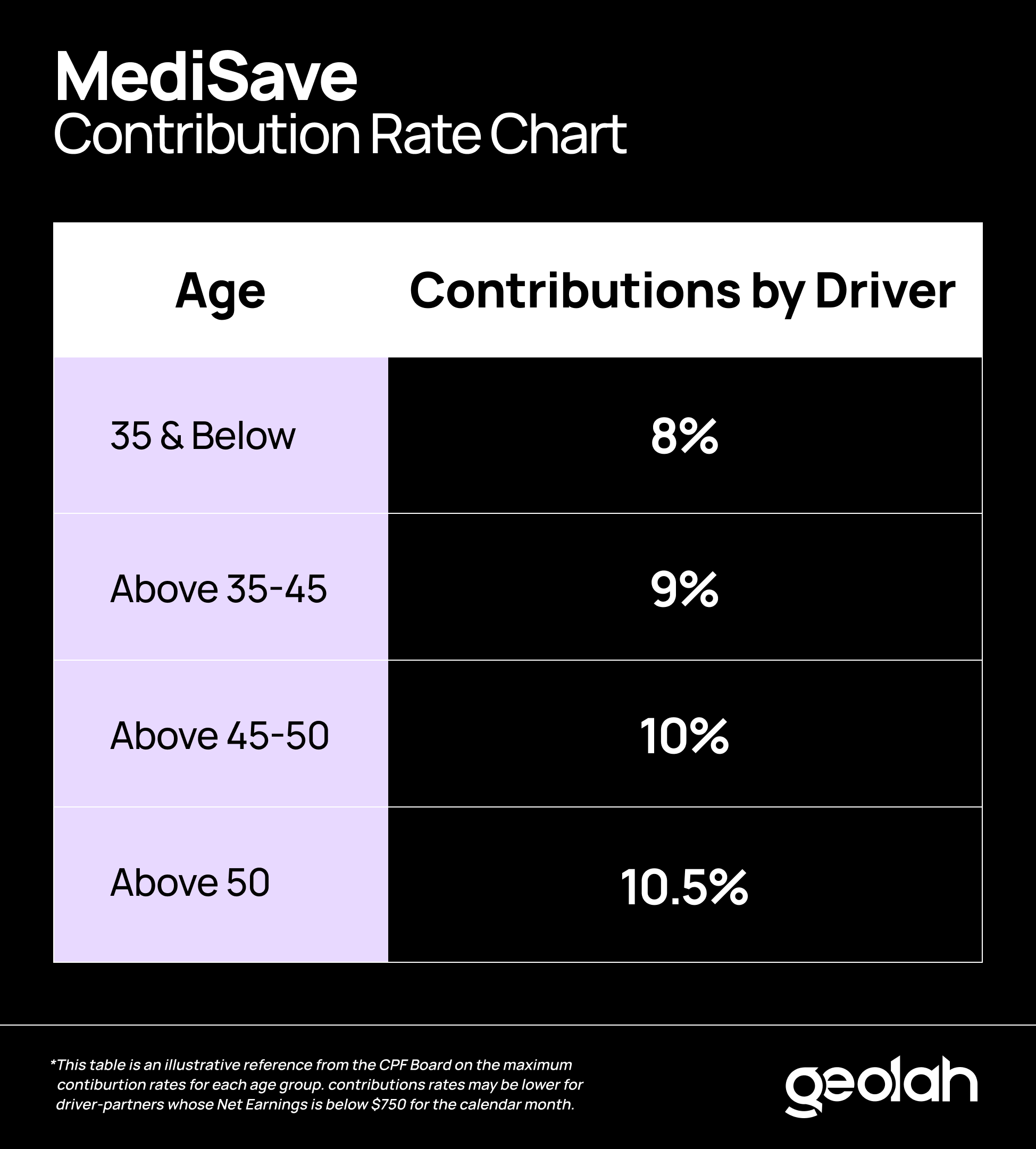

Effective 1 Jan 2025, CPF contributions will be deducted from your platform earnings by Geolah and submitted to the CPF Board (CPFB) every month (if applicable).

Do note that opting in to CPF contributions may lower your take-home earnings.

Net earnings = Gross earnings x (100% – Fixed Expense Deduction Amount of 60%)

Fixed Expense Deduction Amount (FEDA) is the sum of all allowable business expenses incurred in earning platform income and is fixed at 60% for cars.

*This table indicates the maximum contribution rates for each age group and is merely for reference. For your specific contribution, please use the link below. Contribution rates may be lower for driver-partners whose Net Earnings is below $750 for the calendar month.

Calculate your platform workers’ CPF contributions here.

*www.cpf.gov.sg/member/tools-and-services/calculators/platform-worker-cpf-contribution-calculator

See examples below:

Between 2025 and 2028, lower-income platform workers who are required to, or have opted in to make increased CPF Ordinary and Special Account contributions will receive monthly cash payments under the Platform Workers CPF Transition Support (PCTS) scheme. This helps to mitigate the impact of the increased CPF contributions on platform workers during this period of change.

Learn more about CPF contributions for platform workers here.

If you have any further questions, please contact CPFB at: https://www.cpf.gov.sg/service/write-to-us

WIC is Work Injury Compensation* for accident-related injuries that have the same scope as employees under the WIC Act (WICA). It takes effect from 1 Jan 2025 and covers three components:

(1) Medical Expenses

(2) Medical Leave & Hospitalisation Leave

(3) Lump-sum Compensation for Death or Permanent Incapacity

*Note: WICA covers a wider range of compensations for work-related accidents and will therefore replace the existing free accident coverage for all driver-partners and Gigacover’s Freelancer Earnings Protection (FLEP) for Pro/Elite tier driver-partners from 1 Jan 2025.

All driver-partners who transact on the Geolah platform from January 1, 2025, are eligible for WICA coverage for accident-related injuries sustained while working.

You may only submit a claim under one insurance policy at a time.

• If you file a claim through Geolah under WICA, you may submit a claim to your personal insurance provider only after the WICA claim limit is exceeded.

Platform workers are eligible for the same scope and level of Work Injury Compensation (WICA) benefits as employees, including:

• Medical Expenses: Coverage for medical treatment and related expenses.

• Income Loss Compensation: Support during periods of temporary or permanent disability.

• Lump Sum Compensation: For permanent incapacity, current incapacity, or in the event of death.

Please note that compensation for "light duties" is not applicable to platform workers. For further details on WICA benefits, please refer to MOM’s website.

Geolah requires this information to:

• Process WICA Claims: To submit an injury report (iReport) to the relevant authorities on your behalf.

• Facilitate Claim Processing: To assist you in obtaining compensation for medical expenses and potential income loss.

Please note that the WICA claims process will be handled by Geolah, in collaboration with our our Insurance Provider (Etiqa Insurance Pte Ltd).

Ride and delivery coupons